In early 2020, HMRC released the new version of the CEST (check employment status for tax) tool.

However, if the general commentary on the tool is to be believed, the tool is still deficient of things; such as mutuality of obligations.

Furthermore, there are still inconsistencies between how this tool determines results and previous tribunal decisions.

We have tested the tool extensively and in this blog post, we will offer our first impression of the new CEST tool.

What is the CEST tool?

Here is a quick reminder of what the CEST tool is…

Using the CEST tool you can find out if you, or a worker on a specific engagement, should be classed as employed or self-employed for tax purposes.

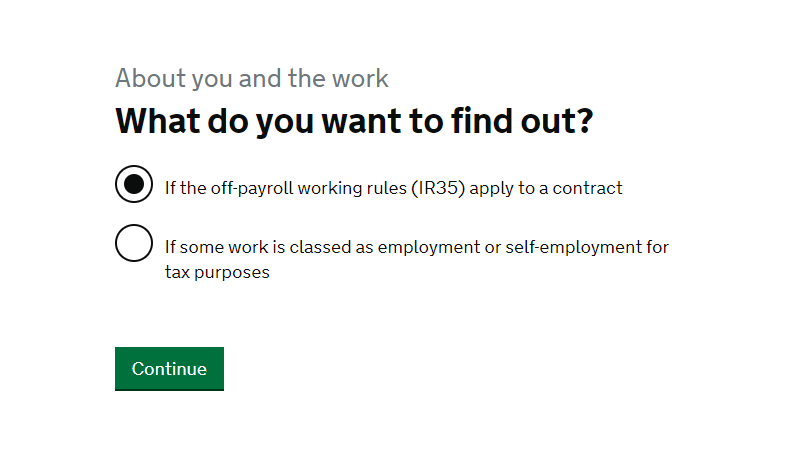

Here is a screenshot of the CEST tool from HMRC’s website.

Why does any HMRC development draw bad press?

The IR35 protection industry is massive. The fear of being found liable for several tens of thousands of pounds has led contractors in droves to buy insurance products, third-party testing and review services.

The market commentary on IR35 is dominated by this industry. Any helpful clarity from HMRC or an attempt to make the determination objective threatens its existence. Therefore, whilst it is useful to listen to their views, it’s foolhardy to take this as gospel.

By way of example, one company is reporting record sales of their products and services and reducing their urgent turnaround IR35 reviews because of unprecedented demand.

If you want to learn more about IR35 take a look at our blog post 5 Things You Probably Didn’t Know About IR35 (That You Probably Should).

What is our first impression of the CEST tool?

The logic of the tool is not very difficult to determine. It places the office-bearer test at the highest level – and if you are engaging contractors on an office bearer basis, they are automatically inside. If not, the tool asks you the next question on substitution.

Previously, the substitution questions were also equally decisive, in that, if you answered them in an IR35 friendly manner you get an outside IR35 determination. Now it is not possible to avoid the other questions in the tool. This is helpful as the tool is capturing more information about your assignment and giving a holistic determination.

The approach is consistent with case law and guidance by tribunal judges. We noticed that it is possible to navigate back from the determination page to the review answers page. There, you can edit individual responses and see what difference your changes would make to the determination. Hence the logic is workable.

Overall, the tool still regards substitution as the key test for outside IR35 determination.

You can find out more about the CEST tool in our CEST Tool mini blog series. Check out Decoding the CEST tool – Part 1 (Office bearer) and Decoding the CEST tool – Part 2 (Substitution).

How helpful is the CEST Tool guidance from HMRC?

We found the guidance provided in the note just below each question very helpful. It is much more reflective of actual working practices. We consider it is positive that HMRC is bridging the gap between its understanding of the working practices and the actual working practices.

We understand that there will be further guidance added on by way of backlinks to other information on the HMRC website in due course.

What is our final judgement on the CEST Tool?

We were impressed and also optimistic that organisations that have already declared their hand out (prematurely, in our view) will reconsider their decision.

We believe organisations can tweak their internal processes ever so slightly, to be complying with the spirit of the legislation.

After all, is that too much of a burden if it gives your organisation access to a highly skilled and experienced external talent pool.

What’s Next?

Our Safe-Engage tool is a handy way of managing IR35 risk.

Safe-Engage is a process we have created to help public and private sector organisations safely engage contractors outside of IR35.

If you are a believer in outside-IR35 contracting, work in the Commercial or Digital Transformation space, and want to safely engage with your client or your contractor, we may be able to step in and be that medium.

Check out our Programme Services for more information.